What is Drive Other Car coverage?

Understanding Drive Other Car commercial auto coverage.

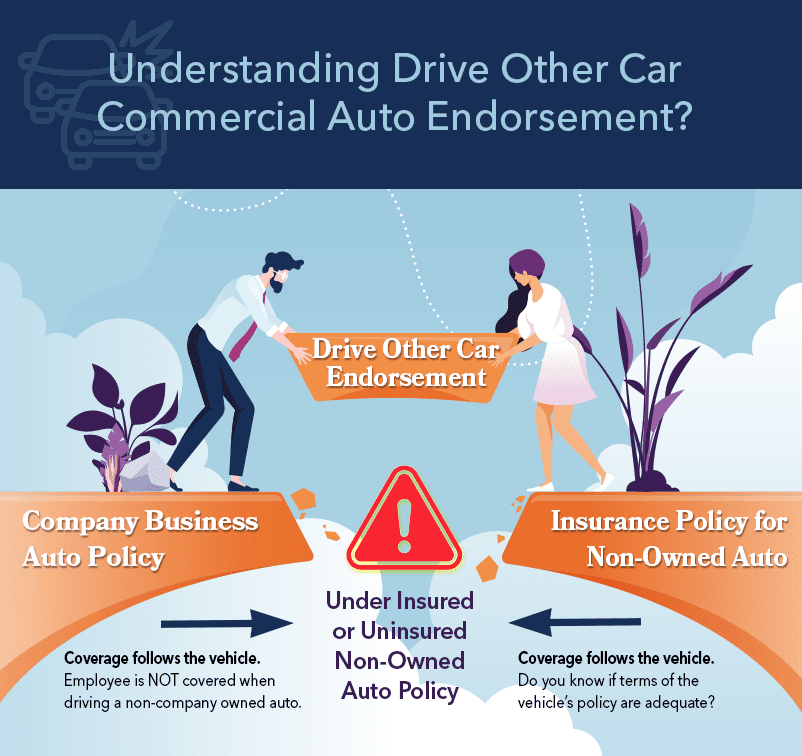

A common gap in commercial auto coverage exists for employees who drive a company vehicle as their household’s only vehicle. They use it for business and personal use and do not own another vehicle, so they do not have personal auto insurance. Without a personal auto insurance policy, a coverage gap exists when that person or other household members drive a non-owned company car, such as a car borrowed from a friend or family member or a rental car.

The business’s commercial auto policy provides coverage for the employee and their spouse when driving the car for business and personal use. The business provides coverage for the vehicle and does not extend when an employee borrows or rents a car that the company does not own.

The company can add a Drive Other Car coverage (DOC) endorsement to close this coverage gap. The DOC helps fill a gap between commercial and personal coverage.

Who needs a Drive Other Car coverage endorsement?

Most people assume that auto insurance follows the person driving the car, but it actually follows the vehicle. If you let someone borrow your car and they are in an accident, your insurance pays, not the insurance of the car’s driver. The problem arises when the vehicle is underinsured or uninsured. If the coverage is inadequate and an accident occurs, the person driving the vehicle could become personally responsible for coming up with the difference. Employees who drive other cars expose themselves to the coverage amounts and limits of the policy or lack of policy on the vehicle.

To help clarify, here are some examples:

Martin drives an employer-supplied car. He does not own his car and, therefore, does not have personal auto insurance. Martin’s roommate Sam asked Martin if he could drive Sam’s car into the city so they could head out for a weekend getaway. Martin gladly agreed. While transporting his Sam’s car, Martin swerves into oncoming traffic to miss hitting a dog that runs across the street. He causes injury to the other driver and later finds out they filed a lawsuit for damages. The liability limits on his friend’s car are the state-required minimums and are not enough to cover the legal expenses and pending legal settlement. Without his own insurance, Martin is personally responsible for covering the loss.

Employees and their spouses are typically covered by the business auto policy when driving a company-owned vehicle for personal use. Since this is their only car, they do not have personal auto insurance. Kara and her parents have permission to drive her dad’s company car for personal use. Kara’s friend, Jamie, invites her to ride with her to the local basketball game. On their way back, Jamie’s car gets struck by an uninsured motorist. Kara is seriously injured. Jamie’s policy has her state’s minimum limits for uninsured motorists, so it does not provide much protection. Several expensive medical bills resulted from the injuries Kara received during the accident. Since Jamie’s auto coverage is insufficient, Kara’s parents must pay the bills out of pocket.

Scott decided it was time to add another family car to the household since his wife’s company provided the only family car. Scott’s friend Matt was selling his sports car. Scott thought it would be great fun to drive on the weekends and decided to give it a test drive. Scott did not realize that Matt had removed insurance coverage from the car since he was not currently driving it. While on the test drive, Scott took a corner too fast, spun out, and drifted off the road into a tree. Even though nobody was hurt, the car suffered extensive damage. Scott ended up purchasing the damaged car since it was his fault, but he did not have a personal auto policy in place to repair or replace the damaged car.

What does a Drive Other Car endorsement cover?

Borrowed or rented automobiles may not have adequate policy limits, leaving the driver uninsured or underinsured. The Drive other Car policy endorsement provides six types of coverage for the driver of a non-company-owned vehicle.

Drive other Car coverage provides coverage for:

- Covered autos liability

- Auto medical payments

- Comprehensive coverage

- Collision

- Uninsured motorist

- Underinsured motorist

Drive other car endorsements are not blanket endorsements. They do not cover everyone in the company that drives a company car unless they are named on the policy.

Extending coverage: The endorsement allows the named insured to designate the individual(s) who are insured by the broadened coverage.

What is the purpose of Drive Other Car coverage?

Drive other Car coverage protects company employees from financial loss if they are in an accident in a non-owned company vehicle.

Does my car insurance let me drive other cars?

Your auto insurance follows the vehicle and not the driver, so as a driver car you drive is not dictated by your insurance. The insurance coverage is determined by the policy terms of that vehicle, no matter who is driving. Financial risk arises when the policy for the vehicle has limited or no coverage. As the car’s driver, the responsibility would be to pay for damages and losses if the policy’s limits were insufficient.

If your company does not extend coverage with a Drive other Car endorsements, you may wonder what to do. Suppose your company does not offer this coverage. In that case, there is also the option to purchase a non-owned named operator policy that provides personal protection for individuals who do not own a car to get personal auto protection. Talk to your insurance advisor for more information.